Daily Briefing

August 17, 2025

August 17, 2025 U.S. equities finished modestly lower on Wednesday as investors awaited key earnings reports from major tech companies and the Federal Reserve's interest rate decision. European markets were mostly higher, while Asian markets saw gains led by Japan.

Stocks fall as bleak jobs report sparks bond rally.

Strong evidence the US labor market is slowing rippled through Wall Street driving stocks lower and bonds higher on concern the Federal Reserve will now have to rush to prevent further weakness.

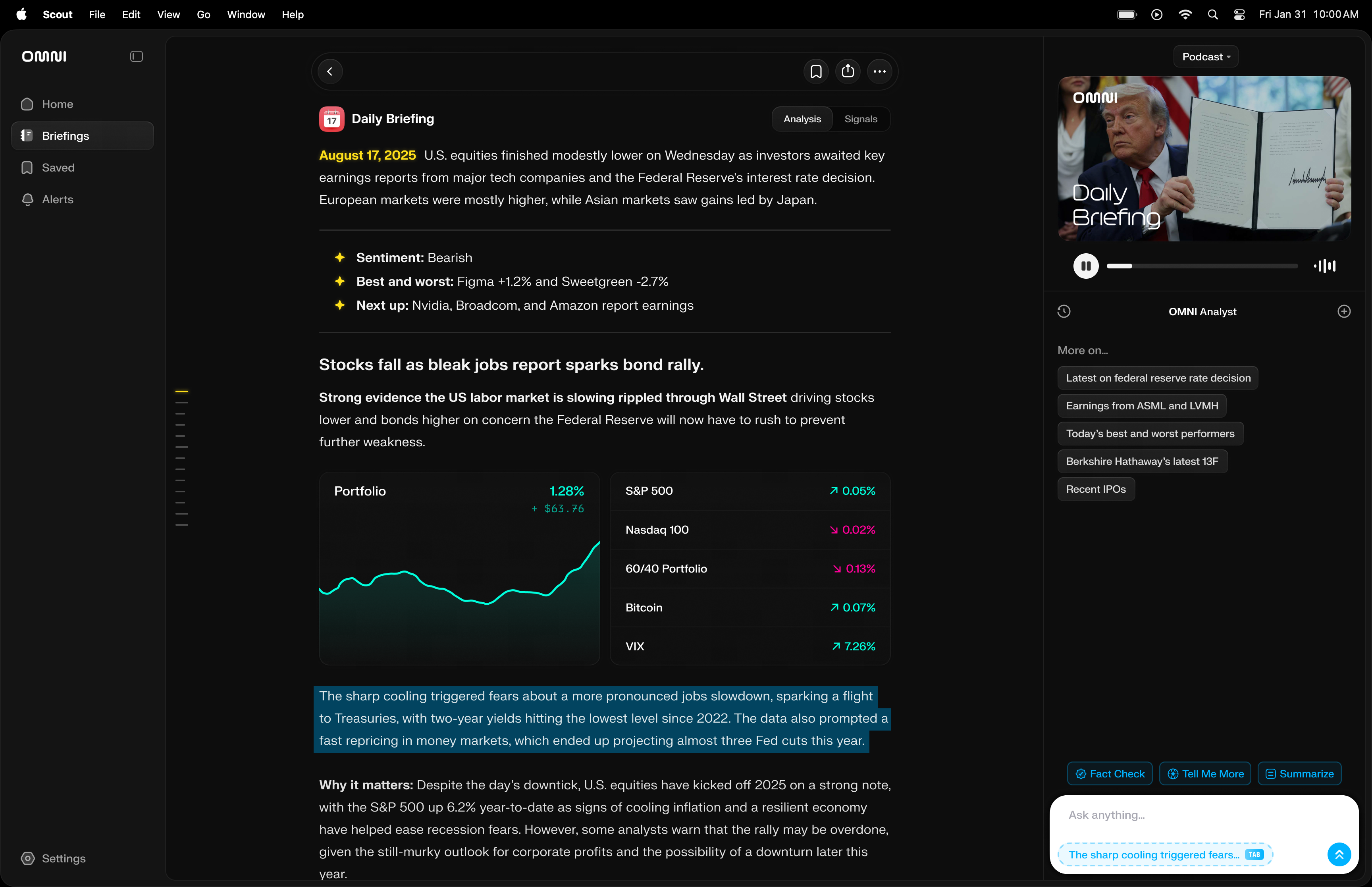

Portfolio

Market Indices

The sharp cooling triggered fears about a more pronounced jobs slowdown, sparking a flight to Treasuries, with two-year yields hitting the lowest level since 2022. The data also prompted a fast repricing in money markets, which ended up projecting almost three Fed cuts this year.

Why it matters:

Despite the day's downtick, U.S. equities have kicked off 2025 on a strong note, with the S&P 500 up 6.2% year-to-date as signs of cooling inflation and a resilient economy have helped ease recession fears. However, some analysts warn that the rally may be overdone, given the still-murky outlook for corporate profits and the possibility of a downturn later this year.